Catastrophe Bonds (Cat Bonds):

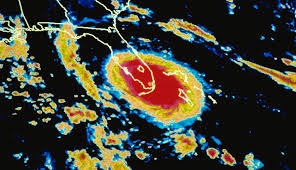

India’s growing vulnerability to climate disasters has reignited policy interest in catastrophe bonds (cat bonds) as a financial instrument for disaster-risk financing.

- Catastrophe bonds (cat bonds) are insurance-linked securities that convert disaster risk into tradable financial products. They transfer the financial risk of natural disasters like earthquakes, cyclones, and floods—from governments or insurers to global capital markets.

Key Features of Cat Bonds:

- High-Yield Returns: Investors earn higher interest rates due to the risk of principal loss.

- Parametric Triggers: Pay-outs are linked to measurable event thresholds (e.g., wind speed, Richter scale magnitude).

- Independence from Market Risk: Natural hazards are uncorrelated with stock market fluctuations, offering true portfolio diversification.

- Fast Disbursal: Enables quick financial assistance post-disaster, reducing reliance on slow government processes.