Account Aggregator:

On September 2 eight of India’s major banks joined the Account Aggregator (AA) network that will enable customers to easily access and share their financial data.

- The framework, which has been under discussion since 2016 and in the testing phase for some time, will now be open to all customers.

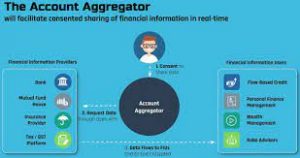

- An Account Aggregator is a non-banking financial company engaged in the business of providing, under a contract, the service of retrieving or collecting financial information pertaining to its customer.

- It is also engaged in consolidating, organising and presenting such information to the customer or any other financial information user as may be specified by the bank.

- The licence for AAs is issued by the RBI, and the financial sector will have many AAs.

- The AA framework allows customers to avail various financial services from a host of providers on a single portal based on a consent method, under which the consumers can choose what financial data to share and with which entity.

- It reduces the need for individuals to wait in long bank queues, use Internet banking portals, share their passwords, or seek out physical notarisation to access and share their financial documents.