Swing Trading:

The Indian stock market has been witnessing volatility amid the ongoing Lok Sabha elections and swing trading has been trending on the internet.

- Swing Trading is a style of trading where investors keep their positions for longer than a single day, typically holding onto stocks for several days or weeks.

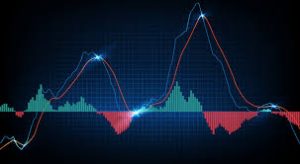

- Its goal is to capture gains in a stock’s value as it swings up and down.

- A swing trader will look for stocks with high volume (a lot of trading activity) and volatility (price movement).

- The entry into a swing trade involves setting up stop-loss orders (to limit potential losses) and target prices (to capture profits) based on support and resistance levels.

- Swing traders buy at support (lower price level) and sell at resistance (higher price level) anticipating the stock’s price to swing back and forth within these bounds.

- The primary goal is to profit from short- to medium-term fluctuations in stock prices.

- Traders aim to enter and exit positions quickly, typically holding stocks for 2 days to a few weeks.

- Swing traders capitalise on both upward and downward movements in the market, seeking to take advantage of trends and momentum.