Today Current Affairs: 14th April 2022 for UPSC IAS exams, State PSC exams, SSC CGL, State SSC, RRB, Railways, Banking Exam & IBPS, etc

Table of Contents

Simplification Of Child Adoption Process In India:

The Supreme Court has agreed to hear a plea that seeks to simplify the legal process involved in child adoption.

- The present adoption procedure is complex. As a result merely 4,000 adoptions happen on a yearly basis in our country.

- The ongoing pandemic has left three crore children orphaned.

- There is also an anomaly on the legislature front as adoption is being governed by the Hindu Adoption and Maintenance Act of 1956 which has a nodal ministry as the Ministry of Law and Justice while the aspects of Orphans are dealt with by the Ministry of Women and Child Development.

- There are also concerns and loopholes wrt inter-country adoptions.

- In India, an Indian citizen or a non-resident Indian (NRI) can adopt a child under the Hindu Adoption and Maintenance Act of 1956 and the Guardian and Wards Act of 1890.

Eligibility criteria for prospective adoptive parents:

- The prospective adoptive parents shall be physically, mentally and emotionally stable, financially capable and shall not have any life threatening medical condition.

- Any prospective adoptive parents, irrespective of his marital status and whether or not he has biological son or daughter, can adopt a child subject to following, namely:-

- the consent of both the spouses for the adoption shall be required, in case of a married couple;

- a single female can adopt a child of any gender;

- a single male shall not be eligible to adopt a girl child;

- No child shall be given in adoption to a couple unless they have at least two years of stable marital relationship.

- The minimum age difference between the child and either of the prospective adoptive parents shall not be less than twenty-five years.

- The age criteria for prospective adoptive parents shall not be applicable in case of relative adoptions and adoption by step-parent.

- Couples with three or more children shall not be considered for adoption except in case of special need children.

Retail Inflation:

Retail inflation accelerated sharply to 6.95% in March, the fastest pace of price gains in almost a year and a half, and marked the third straight month when inflation exceeded the Reserve Bank of India’s tolerance threshold of 6%.

- A surge in food price inflation, which quickened to 7.68% from 5.85% in February, combined with rising fuel prices and producers passing on higher commodity prices and input costs to consumers across goods and services to drive the overall Consumer Price Index (CPI)-based inflation print to a 17-month high.

- Consumers in rural India faced a higher level of inflation than urban residents, with overall rural inflation 154 basis points higher at 7.66%, as the rural food price index sped past 8% to 8.04% in March, from February’s 5.81%.

- The uptick in fuel prices and their ripple effects on transport and logistics costs are expected to intensify in April.

Eggs Under Midday Meal Scheme:

From the next academic session, Karnataka is likely to become the 13th state to provide eggs under the midday meal scheme, which is among the largest initiatives in the world to enhance nutrition levels of school-going children through hot cooked meals.

- The current version of the programme, renamed PM Poshan Shakti Nirman or PM Poshan in 2021, traces its roots to 1995.

- It was launched as a centrally sponsored scheme on August 15 that year across 2,408 blocks for students up to Class 5.

- In 2007, the UPA government expanded it to Class 8.

- The scheme covers 11.80 crore children across Classes 1 to 8 (age group 6 to 14) in11.20 lakh government and government-aided schools and those run by local bodies such as the municipal corporations in Delhi under the provisions of the National Food Security Act, 2013 (NFSA).

First Meeting Of The Inter-Ministerial Coordination Group:

The first meeting of the Inter-Ministerial Coordination Group (IMCG) at Secretary level was convened by India’s Foreign Secretary.

- The IMCG has been set up as a high-level mechanism towards mainstreaming of India’s ‘Neighbourhood First’ policy vision that sought to develop better relations with the country’s neighbours.

- IMCG is supported by inter-ministerial Joint Task Forces (JTFs) convened by joint secretaries in the external affairs ministry.

Highlights of the Meeting:

- The IMCG provided a comprehensive direction with a whole-of-government approach to promote better connectivity, stronger interlinkages and greater people-to-people connect with the neighbours.

- The focus of the meeting was construction of border infrastructure that would facilitate greater trade with neighbours like Nepal; special needs of countries such as Bhutan and Maldives in terms of supply of essential commodities; opening rail connectivity with Bangladesh; Humanitarian assistance to Afghanistan and Myanmar; and Fisheries issue with Sri Lanka.

- IMCG will further improve institutional coordination across government and provide comprehensive direction to this whole-of-government approach to India’s relations with its neighbouring countries.

SVANidhi Se Samriddhi’ Program:

The Ministry of Housing and Urban Affairs (MoHUA) has launched ‘SVANidhi se Samriddhi’ program in additional 126 cities across 14 States/ UTs.

- Quality Council of India (QCI) is the implementing partner for the program.

- SVANidhi se Samriddhi is an additional program of PMSVANidhi, launched on 4th January 2021 in 125 cities to map the socio economic profile of the PM SVANidhi beneficiaries and their families.

- It assesses beneficiaries’ potential eligibility for various Central welfare schemes (8) and facilitates the linkages to these schemes.

- These schemes include Pradhan Mantri Jeevan Jyoti Bima Yojana, PM Suraksha Bima Yojana, Pradhan Mantri Jan Dhan Yojana, Pradhan Mantri Shram Yogi Maandhan Yojana, Registration under Building and other Constructions Workers (Regulation of Employment and Conditions of Service) Act (BOCW), National Food Security Act (NFSA) portability benefit – One Nation One Ration Card (ONORC), Janani Suraksha Yojana, and Pradhan Mantri Matru Vandana Yojana (PMMVY).

- In Phase 1, it covered approximately 35 Lakh Street vendors and their families.

- Phase 2 aims to cover 28 Lakh Street vendors and their families, with a total target of 20 Lakh scheme sanctions for FY 2022-23. The remaining cities would be gradually added to the program.

PM SVANidhi Scheme:

- Prime Minister Street Vendors AtmaNirbhar Nidhi (PM SVANidhi) was announced as a part of the Economic Stimulus-II under the Atmanirbhar Bharat Abhiyan.

- It has been implemented since 1st June 2020, for providing affordable working capital loans to street vendors to resume their livelihoods that have been adversely affected due to Covid-19 lockdowns, with a sanctioned budget of Rs. 700 crore.

- Aims:

- To benefit over 50 lakh street vendors who had been vending on or before 24th March 2020, in urban areas including those from surrounding peri-urban/rural areas.

- To promote digital transactions through cash-back incentives up to an amount of Rs. 1,200 per annum.

- The vendors can avail a working capital loan of up to Rs. 10,000, which is repayable in monthly installments in the tenure of one year.

- On timely/early repayment of the loan, an interest subsidy of 7% per annum will be credited to the bank accounts of beneficiaries through Direct Benefit Transfer on a quarterly basis.

- There will be no penalty on early repayment of the loan.

- The vendors can avail the facility of the enhanced credit limit on timely/early repayment of the loan.

Global Wind Report 2022:

The Global Wind Report for 2022 was published by the Global Wind Energy Council (GWEC).

- GWEC was established in 2005 to provide a credible and representative forum for the entire wind energy sector at an international level.

Highlights of the Report:

- Wind energy installations every year across the world must quadruple from the 94 GW (Gigawatt) installed in 2021 within this decade to meet the global climate targets.

- Without the necessary amplification, restricting global warming over pre-industrial levels to 1.5 degrees Celsius — a target set by the Paris Agreement — and achieving Net Zero emissions by 2050 may become difficult.

- New installations of 93.6 GW in 2021 brought global cumulative wind energy capacity to 837 GW, a Year-on-Year (YoY) growth of 12%.

- The onshore wind market added 72.5 GW worldwide.

- That is 18% lower than the previous year due to a slowdown in China and the US, the world’s two largest wind markets.

- The offshore wind market enjoyed its best ever year in 2021, with 21.1GW commissioned.

- New offshore installations in 2022 are likely to decline to the 2019 / 2020 levels.

- Decline will be primarily due to the reduction of installations in China.

- However, market growth is expected to regain momentum from 2023, eventually passing the 30GW-mark in 2026.

- Offshore wind energy generation increases return on investment, along with reducing greenhouse gas emissions.

- Carbon dioxide emissions can reduce by 0.3-1.61 gigatonnes every year by 2050 if offshore wind energy generation is scaled up.

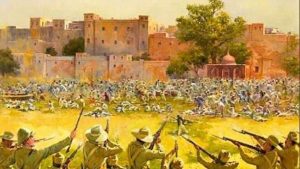

Jallianwala Bagh Massacre : 103 Years Of The Incident

The Prime Minister paid tributes to people killed in the Jallianwala Bagh massacre in 1919.

- He asserted that their unparalleled courage and sacrifice will keep motivating the coming generations. 13th April, 2022 marks the 103 years of the incident.

- Earlier, the Gujarat government marked 100 years of the Pal-Dadhvav killings, calling it a massacre “bigger than the Jallianwala Bagh”.

- The Jallianwala Bagh massacre or the Amritsar massacre of 13th April 1919 accounts for the gruesome execution of hundreds of innocent people by the Gurkha British Indian army on the orders of the then Anglo-Indian Brigadier R.E.H. Dyer.

- These people were protesting peacefully against the Rowlatt Act 1919.

- Mahatma Gandhi wanted non-violent civil disobedience against such unjust laws, which would start with a hartal on 6th April 1919.

- In Punjab, on 9th April 1919, two nationalist leaders, Saifuddin Kitchlew and Dr. Satyapal, were arrested by the British officials without any provocation except that they had addressed protest meetings, and taken to some unknown destination.

- This caused resentment among the Indian protestors who came out in thousands on 10th April to show their solidarity with their leaders.

- To curb any future protest, the government put martial law in place and law and order in Punjab was handed over to Brigadier-General Dyer.

- On 13th April, Baisakhi day, a large crowd of people mostly from neighbouring villages, unaware of the prohibitory orders in Amritsar gathered in the Jallianwala Bagh.

- Brigadier-General Dyer arrived on the scene with his men.

- The troops surrounded the gathering under orders from General Dyer and blocked the only exit point and opened fire on the unarmed crowd killing more than 1000 unarmed men, women, and children.

Cardless Cash Withdrawals At ATMs : RBI

The Reserve Bank of India (RBI) announced cardless cash withdrawals at ATMs across the country which will enable consumers to use Unified Payment Interface (UPI) on their smartphones to withdraw cash from Automatic Teller Machine (ATMs).

- It would help prevent frauds like card skimming and card cloning.

- Currently, only existing customers of a few banks are allowed to withdraw cash without cards, and from specific bank’s ATM networks.

- However, the RBI’s move to allow interoperability in cardless withdrawals will enable users to take cash from any and all ATMs.

- The move will invite more players into the payment ecosystem in India to innovate and solve further problems of customers.

What Is The Concessional Tax Rate Regime?

Government data has shown that the concessional corporate tax rate announced by the Union government in September 2019 saw two out of every five new domestic manufacturing companies incorporated in 2019-20 (April-March) opting for the reduced 15% tax rate.

- Corporation tax is a direct tax placed on a company’s net income or profit from its operations.

- Corporation tax is payable by both public and private companies registered in India under the Companies Act 1956.

- Corporate tax is a tax imposed on the net income of the company, whereas income tax is a type of tax imposed on an individual’s income, such as wages and salaries.

Concessional Tax Rate Regime:

- A reduction made by the government in the amount of tax that a particular group of people or type of organization has to pay or a change in the tax system that benefits those people.

- Before, this scheme, Corporate tax rate, was 22% without exemptions.

- Under the new regime introduced in September 2019, a tax rate of 15% was announced under Section 115BAB for newly incorporated domestic companies, which make fresh investments by 31st March, 2023, for manufacturing, production, research or distribution of such articles or things manufactured.

- This was extended by one year in this year’s Budget (2022-23) to 31st March, 2024.

- A similar concessional rate regime was also introduced by the Centre for personal income taxpayers effective 2020-21 (Income Tax Act), under which assessees willing to forgo deductions and exemptions such as those under sections 80C, 80D, house rental allowance and leave travel allowance could choose to pay tax on their income at a reduced rate.

- Even though the government has not yet published data on taxpayers opting for the new personal income tax regime, it is indicated that the new regime has not drawn taxpayers in large numbers prompting the government to take a relook.

What Is a CALM System?

The Indian Army has issued a Request for Information (RFI) for the Canister Launched Anti-Armour Loiter Ammunition (CALM) System of its mechanised forces.

- Earlier, the Indian Army had issued a RFI for the supply of Articulated All-Terrain Vehicles to be deployed in Ladakh and Kutch.

- The CALM System is a pre-loaded canister with loiter ammunition or a drone. Loiter munitions are a mix of a surface-to-surface missile and a drone.

- Once fired it can remain aloft for a period of time over the area of operation, and when a target is sighted it can be guided down to destroy the target with the explosive payload that it carries.

- Usually, loiter ammunition carry a camera which is nose-mounted and which can be used by the operator to see the area of operation and choose targets.

- These munitions also have variants which can be recovered and reused in case they are not used for any strike.

- The top down attack capability of the loiter ammunition gives it a big advantage over targets such as tanks which are vulnerable to any attack on the top where the armour protection is weak.

- Loiter munitions are smaller, cheaper and less complex systems than combat or armed drones.

- The CALM System had been very effectively used in the Armenia-Azerbaijan conflict in 2021 where the Azerbaijan forces made extensive use of Israeli systems to wreak havoc on Armenian tanks, radar systems, communication hubs and other military targets.

- The Russian military is also using their ZALA KYB loiter ammunition in Ukraine while some reports say that the US has also provided Ukraine with its Switchblade loiter munitions that could target Russian armour 10 km away.