Today’s Current Affairs: 22nd December 2022 for UPSC IAS exams, State PSC exams, SSC CGL, State SSC, RRB, Railways, Banking Exam & IBPS, etc

Table of Contents

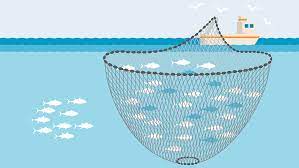

Purse Seine Fishing:

Certain coastal states had imposed a ban on purse seine fishing. But the central government has criticized the move and said it is unjustified.

- A purse seine is made of a long wall of netting framed with floating and leadline and having purse rings hanging from the lower edge of the gear, through which runs a purse line made from steel wire or rope which allows the pursing of the net.

- Purse-seine fishing in open water is generally considered to be an efficient form of fishing

- It has no contact with the seabed and can have low levels of bycatch (accidental catch of unwanted species)

- Purse seines can also be used to catch fish congregating around fish aggregating devices

- This mode of fishing has not resulted in any serious resource depletion so far, given the available evidence”.

- Purse-Seine fishing is known to harm endangered species. As this mode of fishing uses a wide net to draw in not only targeted fish but also at risk varieties, including turtles.

- Expert panel recommended purse seiners fish in territorial waters and the Indian Exclusive Economic Zone (EEZ) subject to certain conditions.

Lok Sabha Passes Anti-Maritime Piracy Bill:

Lok Sabha passes Anti-maritime Piracy Bill to promote trade security. The bill will bring the UN Convention on the Law of the Sea into domestic law and enable Indian authorities to take action against piracy on the high seas

- IPC is not valid for foreigners in international waters: Previously, pirates were prosecuted under the Indian Penal Code, 1860 (IPC).

- However, India’s sovereignty is delimited by the outer boundary of its territorial waters— 12 nautical miles from the coast.

- Acts of piracy committed by a foreigner outside India’s territorial waters cannot be an offence under the IPC, and those accused in piracy cases have been acquitted due to the lack of jurisdiction.

- Incidence of Piracy: Gulf of Aden has been one of the deadliest areas in the oceans due to a large number of piracy incidents.

- Due to an increased naval presence in the Gulf of Aden, it has been observed that piracy operations are shifting towards the east and south, which increases their proximity to India’s west coast.

Urban 20:

Under the G20, the presidency of India from December 01, 2022, to November 30, 2023, the Ministry of Housing and Urban Affairs is organizing the Urban 20 event.

- U20 is an important city diplomacy initiative, which reinforces the role of cities in taking the sustainable agenda forward.

- Urban-20 (U20), one of the Engagement Groups of G20, provides a platform for cities from G20 countries to facilitate discussions on various important issues of urban development including climate change, social inclusion, sustainable mobility, and affordable housing, and propose collective solutions.

- The U20 2023 Cycle will be chaired by the City of Ahmedabad

- The Urban 20 (U20) is a city diplomacy initiative launched on December 12, 2017, at the One Planet Summit in Paris.

- It aims to facilitate lasting engagement between the G20 and cities, raise the profile of urban issues in the G20 agenda, and establish a forum for cities to develop a collective message and perspective to inform G20 negotiations.

- C40 Cities (C40) and United Cities and Local Governments (UCLG) convene the U20 under the leadership of a Chair city that rotates annually, based in the G20 host country.

- Ahmedabad will showcase its unique urban development and climate change initiatives and rich culture and heritage to the participants.

Global Minimum Tax:

EU members have agreed to implement a minimum tax rate of 15% on big businesses in accordance with Pillar 2 of the global tax agreement framed by the Organisation for Economic Cooperation and Development (OECD) in 2021.

- In 2021, 136 countries including India had agreed on a plan to redistribute tax rights across jurisdictions and enforce a minimum tax rate of 15% on large multinational corporations.

- A Global Minimum Tax (GMT) applies a standard minimum tax rate to a defined corporate income base worldwide.

- The OECD developed a proposal featuring a corporate minimum tax of 15% on foreign profits of large multinationals, which would give countries new annual tax revenues of USD 150 billion.

- The framework of GMT aims to discourage nations from tax competition through lower tax rates that result in corporate profit shifting and tax base erosion.

- Key Points of the Plan:

- Two Pillar Plan:

- Pillar 1: 25% of profits of the largest and most profitable Multinational Enterprise (MNEs) above a set profit margin would be reallocated to the market jurisdictions where the MNE’s users and customers are located.

- It also provides for a simplified and streamlined approach to the application of the arm’s length principle to in-country baseline marketing and distribution activities.

- Pillar 2: It provides a minimum 15% tax on corporate profit, putting a floor on tax competition.

- This will apply to multinational groups with annual global revenues of over 750 million euros.

- Governments across the world will impose additional taxes on the foreign profits of MNEs headquartered in their jurisdiction at least to the agreed minimum rate.

- This means that if a company’s earnings go untaxed or lightly taxed in one of the tax havens, their home country would impose a top-up tax that would bring the effective rate to 15%.

- Pillar 1: 25% of profits of the largest and most profitable Multinational Enterprise (MNEs) above a set profit margin would be reallocated to the market jurisdictions where the MNE’s users and customers are located.

- Two Pillar Plan:

First Joint Finance And Health Task Force:

The first Joint Finance and Health Task Force (JFHTF) meeting under India’s G20 Presidency was held in virtual mode on December 20.

- The meeting was co-chaired by Italy and Indonesia.

- The Bali Leaders’ Declaration 2022 extended the mandate of the Task Force to continue the collaborations between Finance and Health Ministries for Pandemic Prevention, Preparedness, and Response.

- The 1st JFHTF enabled discussions on the mandates specified by the Bali Leaders’ Declaration.

- The Task Force Secretariat worked with the Indian Presidency and Co-Chairs Italy and Indonesia to draft the work plan for next year and beyond, which was designed around Indian Presidency’s Global Health Priorities for 2023.

- The Task Force will also promote the exchange of experiences and best practices, developing coordination arrangements between Finance and Health Ministries, promoting collective action and encouraging effective stewardship of resources to address the existing financing gaps in pandemic preparedness and response.

Digital India Awards 2022:

The Smart Cities Mission recently won the Platinum Icon in the Digital India Awards 2022 for their initiative “Data Smart Cities: Empowering Cities through Data”.

Digital India Awards 2022:

- The Smart Cities Mission won the award under the ‘Data Sharing and Use for Socio-Economic Development’ category.

- This category ‘emphasizes on sharing of Government Data by Ministries/Departments/Organizations, States, Cities and ULBs to create a vibrant data for analysis, decision-making, innovation etc.

- The initiative is a key step in creating a robust data ecosystem that enables evidence-based decision-making in cities.

- The Digital India Awards (DIA) is a prestigious National competition that seeks to encourage and honour innovative digital solutions by government entities in realising the Digital India vision.

- These are conducted by the National Informatics Centre (NIC) under the Ministry of Electronics & Information Technology (MeitY).

ARNALA Ship:

The ARNALA ship is inducted into the Indian Navy

- The ARNALA ship is built under ASW SWC Project.

- Arnala class of ships will replace the Abhay class ASW Ships of the Indian Navy and are designed to undertake anti-submarine operations in coastal waters and Low-Intensity Maritime Operations (LIMO) including subsurface surveillance in littoral waters.

- The ship has been named Arnala to signify the strategic maritime importance accorded to the island of Arnala by the great Maratha warrior, Chhatrapati Shivaji Maharaj.

ASW SWC Project:

- It is the Anti-Submarine Warfare Shallow Water Craft project under which many ships are being built for the Indian Navy

- The ASW SWC ships will be capable of detecting and neutralizing various underwater threats.

- ASW SWC ships have a displacement of 900 tons with a maximum speed of 25 knots and an endurance of 1800 NM.

- These ships will have over 80% indigenous content, ensuring that large-scale defense production is executed by Indian manufacturing units thereby generating employment and capability build up within the country.

Tentative List Of UNESCO World Heritage Sites:

Three heritage sites were added to the tentative list of UNESCO World Heritage sites namely; the Sun Temple at Modhera and Vadnagar town from Gujarat and rock-cut relief sculptures of Unakoti of Tripura.

- According to UNESCO, A Tentative List is an inventory of those properties which each nation intends to consider for nomination.

Sun Temple of Modhera:

- The Sun Temple, Modhera dedicated to Surya dev (The Sun God), is one of the remarkable gems of temple architecture in India.

- It is an exemplary model of the Maru-gurjara architecture style of the 11th century of western India under the patronage of the Solanki dynasty.

- The age of the temple may be inferred from its style belonging to the reign of Bhimadeva I (1022-1063 CE).

- It consists of the main temple shrine (garbhagriha), a hall (gadhamandapa), an assembly hall (Sabhamandapa or rangamandapa) and a sacred pool (Kunda) which is now called Ramakunda.

- This east-facing temple is built of bright yellow sandstone.

Rock-cut relief sculptures of Unakoti:

- The site of Unakoti Rock-cut relief sculptures is located in the north-eastern part of Tripura, which was built during 8th to 12th CE.

- The vertical surface of the Unakoti hills was used by the ancient people to carve various mythological scenes such as the different iconographic forms of Siva, Ganesha, Uma-Maheshwara.

- Majestic rock-cut images on the vertical surface of the hill and fallen boulders.

- Loose sculptures of smaller and medium sizes scattered on the hill.

- The influence of Buddhism is also seen in the sculptures of the region. There are various depictions of Boddhisattavas, Buddha and Buddhist motifs also found here.

Vadnagar:

- Vadnagar was situated at a strategic location where two major ancient trade routes crossed each other. One of them joined central India with the Sindh and further northwest regions while another connected the port towns on the Gujarat coast to northern India.

- Vadnagar town is a multi-layered and multi-cultural mercantile settlement with its history stretching back to nearly 8thCentury BCE.

Environmental-Social-Governance:

Indian Institute of Corporate Affairs, an autonomous institution under the aegis of the Ministry of Corporate Affairs, Government of India recently launched a programme to create ‘impact leaders’ in the areas of Environmental-Social-Governance (ESG).

- Environmental-Social-Governance is a term that has been coined to refer to specific data designed to be used by investors for evaluating the material risk that the organization is taking on based on the externalities it is generating.

- ESG can be categorised as:

- Environmental aspect: Data is reported on climate change, greenhouse gas emissions, biodiversity loss, deforestation, pollution, energy efficiency and water management.

- Social aspect: Data is reported on employee safety and health, working conditions, diversity, equity, and inclusion, conflicts and humanitarian crises and is relevant in risk and return assessments directly through results in enhancing (or destroying) customer satisfaction and employee engagement.

- Governance aspect: Data is reported on corporate governance such as preventing bribery, corruption, diversity of Board of Directors, executive compensation, cybersecurity and privacy practices, management structure, executive pay, diversity in leadership, manner in which the leadership responds to and interacts with shareholders, audits, internal controls, and shareholder rights.

AYURSWASTHYA Yojana:

The Ministry of Ayush is running a Scheme namely, AYURSWASTHYA Yojana.

- AYURSWASTHYA Yojana is a Central Sector Scheme.

- It is having two components: AYUSH and Public Health (PHI)

- Centre of Excellence (CoE) from the Financial Year 2021-22 by merging two erstwhile schemes of this Ministry namely

- Central Sector Scheme of Grant-in-Aid for Promotion of AYUSH Intervention in Public Health Initiatives (PHI) and

- Central Sector Scheme for assistance to AYUSH organizations (Government / Non-Government Non-Profit) engaged in AYUSH Education/ Drug Development & Research / Clinical Research etc. for upgradation to Centre of Excellence (CoE).

- Centre of Excellence (CoE) from the Financial Year 2021-22 by merging two erstwhile schemes of this Ministry namely

- Under the Centre of Excellence component of AYURSWASTHYA Yojana, financial assistance is provided to eligible individual organizations/institutes for establishing and upgrading their functions & facilities and/or for research & development activities in AYUSH.

- The maximum admissible financial assistance under the Centre of Excellence component of AYURSWASTHYA Yojana, to an organization/institute is 10.00 crores for maximum period of three years.