National Savings Certificate: Investment

The Prime Minister recently declared Rs 9.12 lakh investment in the National Savings Certificate (NSC) scheme in his nomination filing.

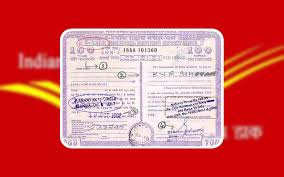

- National Savings Certificate (NSC) is a fixed-income investment scheme launched by the government of India.

- It aims at encouraging users, who are primarily low- to mid-income investors, to invest as well as save taxes.

- You can invest in NSC from the nearest post office in your name, for a minor or with another adult as a joint account.

- The certificates earn an annual fixed interest, which is revised every quarter by the government, thus guaranteeing a regular income for the investor.

- Maturity Period: Five years.

- The amount of NSCs that can be purchased has no upper limit.

- As a government-backed tax-saving scheme, the principal invested in NSC qualifies for tax savings under Section 80C of the Income Tax Act up to Rs. 1.5 lakhs annually.

- It can be easily bought from any post office on submission of the required KYC documents.

- Also, it is easy to transfer the certificate from one PO to another, as well as from one person to another, without impacting the interest accrual/maturity of the original certificate.

- NSC certificates are accepted as collateral or security for secured loans in Banks and NBFCs.

- The investor can nominate any family member (even a minor) so that they can inherit it in the unfortunate event of the investor’s demise.

- Generally, one cannot exit the scheme early except on the death of an investor, on a court order, or on forfeiture by a pledgee who is a Gazetted Government Officer for it.