Yen Carry Trade:

Major stock markets across the world experienced their sharpest decline in decades and the yen carry trade was one reason behind this decline.

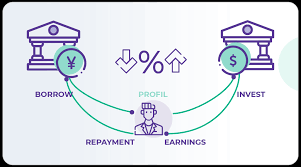

- Yen carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return.

- It is typically based on borrowing in a low-interest rate currency and converting the borrowed amount into another currency

- Generally, the proceeds would be deposited in the second currency if it offers a higher interest rate.

- The proceeds also could be deployed into assets such as stocks, commodities, bonds, or real estate that are denominated in the second currency.

- The Japanese yen is considered one of the most widely used currencies for this purpose.

- In yen carry trade, investors, including retail Japanese investors borrow at a low interest rate at home and purchase assets in another country with higher returns, such as overseas equities and bonds.