Today Current Affairs: 12th November 2022 for UPSC IAS exams, State PSC exams, SSC CGL, State SSC, RRB, Railways, Banking Exam & IBPS, etc

Table of Contents

2nd BIMSTEC Agriculture Ministers Meeting:

India hosted the Second Agriculture Ministerial-level meeting of the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC).

Highlights of the Meeting:

- India urged the member countries to cooperate in developing a comprehensive regional strategy to strengthen cooperation for the transformation of agriculture.

- It also urged the member countries to adopt a conducive agricultural food system and a healthy diet for all by referring to the importance of millet as a nutritious food and the efforts made by India to promote millet and its products during the International Year of Millets – 2023.

- Natural and ecological farming should be promoted to conserve agricultural biodiversity and reduce the use of chemicals.

- Along with digital farming and precision farming, initiatives under the ‘One Health’ approach are also taking shape in India.

- Highlighted India’s statement at the 5th BIMSTEC Summit held in Colombo in March, 2022 on enhancing regional cooperation between BIMSTEC nations for food security, peace and prosperity in the region.

- Adopted the Action Plan for Strengthening BIMSTEC Agricultural Cooperation (2023-2027).

- An MoU (Memorandum of Understanding) between the BIMSTEC Secretariat and the International Food Policy Research Institute (IFPRI) has been signed and approval has been given to bring fisheries and livestock sub-sectors under the Agricultural Working Group.

BIMSTEC:

- The BIMSTEC is a regional organisation comprising seven Member States: five deriving from South Asia, including Bangladesh, Bhutan, India, Nepal, Sri Lanka and two from Southeast Asia, including Myanmar and Thailand.

E-waste Management rules 2022:

The government has notified E-waste (management) rules 2022, which will come into force from 1 April next year and apply to every manufacturer, producer , dismantler and recycler of e-waste

Key provisions of the Rules:

- Restricted the use of hazardous substances (such as lead, mercury, and cadmium) in manufacturing electrical and electronic equipment that have an adverse impact on human health and the environment.

- Increased the range of electronic goods covered e.g., laptops, mobile, cameras etc.

- Producers of electronic goods have to ensure at least 60% of their electronic waste is collected and recycled by 2023 with targets to increase them to 70% and 80% in 2024 and 2025, respectively.

- Companies will report these on an online portal.

- Extended Producer Responsibility Certificates (similar to carbon credit mechanism): This will allow the offsetting of e-waste responsibility to a third party.

- ‘Environmental compensation’ to be provided by the companies that don’t meet their target.

- Role of State Governments: They will earmark industrial space for e-waste dismantling and recycling facilities, undertaking industrial skill development and establishing measures for protecting the health and safety of workers engaged in the dismantling and recycling facilities for e-waste.

- Role of manufacturers:

- Make the end product recyclable

- A component made by different manufacturers be compatible with each other

- Role of Central Pollution Control Board: It shall conduct random sampling of electrical and electronic equipment placed on the market to monitor and verify the compliance of reduction of hazardous substances provisions.

11th Session Of The India-Belarus Inter-Governmental Commission:

The 11th Session of the India-Belarus Inter-Governmental Commission on Trade, Economic, Scientific, Technological and Cultural Cooperation was held.

Highlights of the Session:

- The Intergovernmental Commission reviewed the results of bilateral cooperation that took place after the tenth session of the Commission in 2020.

- While expressing satisfaction at the progress made in regard to some projects, the Commission also directed concerned Ministries and Departments to focus on key sectors in the trade & investment spheres to finalise concrete outcomes.

- India and Belarus reiterated their strong desire to further broaden their cooperation with emphasis on key sectors such as pharmaceuticals, financial services, science and technology, heavy industries, culture, tourism, and education.

- The two ministers directed their respective business communities to engage with each other in these sectors to further mutually beneficial cooperation.

- The two sides agreed to promote cooperation among various states in India and regions in Belarus, especially in focus areas.

India Agribusiness Awards 2022:

National Fisheries Development Board (NFDB), was one of the organizations to be awarded the “India Agribusiness Awards 2022” for the best Agribusiness Award under the Fisheries Sector.

National Fisheries Development Board(NFDB):

- The National Fisheries Development Board (NFDB) was established in 2006.

- It is an autonomous organization under the administrative control of the Department of Fisheries, Ministry of Fisheries, Animal Husbandry and Dairying, Government of India to enhance fish production and productivity in the country and to coordinate fishery development in an integrated and holistic manner.

Global Offshore Wind Alliance:

Nine countries including Britain, Germany, the United States and Japan joined an international alliance recently at the UN COP27 climate summit, to encourage the development of offshore wind power.

- The Global Offshore Wind Alliance (GOWA), established to “remove barriers” to the energy.

- It was set up by the International Renewable Energy Agency (IRENA), Denmark and the Global Wind Energy Council.

- The alliance is supported by a number of organizations which are actively promoting the offshore wind industry in their different regions.

- It aims to provide the growing offshore wind industry with a one-stop shop overview of all offshore wind industry events around the world.

- Both IRENA and the International Energy Agency (IEA) expect that offshore wind capacity will need to exceed 2000 GW in 2050, from just over 60 GW today, to limit the rise in global temperatures to 1.5 degree Celsius and achieve net zero.

- To reach this target, GOWA will aim to contribute to accelerating growth to reach a total of at least 380 GW installed capacity by the end of 2030.

Report On Municipal Finances : RBI

The Reserve Bank of India (RBI) has released the Report on Municipal Finances, compiling and analyzing budgetary data for 201 Municipal Corporations (MCs) across all States.

- The RBI Report explores ‘Alternative Sources of Financing for Municipal Corporations’ as its theme.

Findings:

- There have been several lacunae in the working of MCs and no appreciable improvement in their functioning despite institutionalisation of the structure of local governance in India.

- The availability and quality of essential services for urban populations in India has consequently remained poor.

- Most municipalities only prepare budgets and review actuals against budget plans but do not use their audited financial statements for balance sheet and cash flow management, resulting in significant inefficiencies.

- While the size of the municipal budgets in India are much smaller than peers in other countries, revenues are dominated by property tax collections and devolution of taxes and grants from upper tiers of government, resulting in lack of financial autonomy.

- Minimal Capital Expenditure committed expenditure in the form of establishment expenses, administrative costs and interest and finance charges is rising, but capital expenditure is minimal.

- MCs mostly rely on borrowings from banks and financial institutions and loans from centre/ state governments to finance their resource gaps in the absence of a well-developed market for municipal bonds.

- Municipal revenues/expenditures in India have stagnated at around 1 % of GDP (Gross Domestic Product) for over a decade.

- In contrast, municipal revenues/ expenditures account for 7.4 % of GDP in Brazil and 6 % of GDP in South Africa.

- Governments have not set up State Financial Commissions (SFCs) in a regular and timely manner even though they are required to be set up every five years.

- Accordingly, in most of the States, SFCs have not been effective in ensuring rule-based devolution of funds to Local governments.

Central Counterparty Clearing house (CCP):

The European Union’s financial markets regulator European Securities and Markets Authority (ESMA) said it will withdraw recognition of six Indian clearing bodies or central counterparties (CCPs).

- These six CCPs are

- Clearing Corporation of India (CCIL),

- Indian Clearing Corporation Ltd (ICCL),

- NSE Clearing Ltd (NSCCL),

- Multi Commodity Exchange Clearing (MCXCCL),

- India International Clearing Corporation (IFSC) Ltd (IICC) and

- NSE IFSC Clearing Corporation Ltd (NICCL).

- As per the European Market Infrastructure Regulations (EMIR), a CCP in a third country can provide clearing services to European banks only if it is recognized by the ESMA.

- The ESMA said it reviewed the recognition of all third country CCPs (TC-CCPs) that had been recognised prior to September 21, 2020, as per the European Market Infrastructure Regulation (EMIR) regime.

- The decision to derecognise Indian CCPs came due to ‘no cooperation arrangements’ between the ESMA and Indian regulators — the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI) and the International Financial Services Centres Authority (IFSCA).

- The EU regulator said it will defer the application of the withdrawal decisions until April 30, 2023 to mitigate the adverse impact of the move on EU market participants.

- The ESMA wants to supervise these CCPs, which the Indian regulators are not in favour of as they feel that these entities have robust risk management and there is no need for a foreign regulator to inspect them.

Central Counterparty Clearing house (CCP):

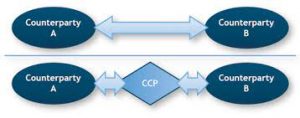

- A central counterparty clearing house (CCP) is an entity that helps facilitate trading in various European derivatives and equities markets.

- Typically operated by the major banks in each country, CCPs strive to introduce efficiency and stability into various financial markets.

- It reduces counterparty, operational, settlement, market, legal, and default risk for traders.

- A CCP acts as a counterparty to both sellers and buyers, collecting money from each, which allows it to guarantee the terms of a trade.

- A CCP is authorised by the RBI to operate in India under Payment and Settlement Systems Act, 2007.

Veerangana Sewa Kendra:

Indian Army has recently launched a single window facility – Veerangana Sewa Kendra (VSK) for welfare and grievances redressal of Veer Naris.

- The system caters to registering grievances with tracking, monitoring, and regular feedback to the applicant.

- Veernaris / Next of Kin will have multiple means for approaching the VSK through telephone, SMS, WhatsApp, Post, e-mail and walk-ins to seek assistance.

- Stakeholders can monitor the status of grievances through Customer Relationship Management (CRM) software.

- The facility has been launched as Veer naris are employed as VSK staff to maintain inherent connection and empathy with the beneficiaries.

- The VSK is one of its kind initiatives by the Indian Army towards extending genuine care and support to its widows and veer naris and NoKs.

- Veerangana Sewa Kendra (VSK) will be available as a service to the Indian Army Veterans Portal

Compulsorily Convertible Preference Shares:

Insurance regulator IRDAI has rejected Fairfax proposal to convert the company’s holdings in compulsory convertible preferred shares (CCPS) issued by Go Digit Infoworks into equity shares.

- CCPS, or Compulsorily Convertible Preference Shares, are a key element of startup financing.

- It gives the assurance of a fixed rate of return plus the opportunity for capital appreciation.

- These shares carry certain terms—if an early investor has CCPS, he can have more rights than other investors who come in later at a higher valuation.

- It also helps investors maintain their stake and have a say even if their stake gets diluted later.

- However, these shares get converted to ordinary equity shares after 10-15 years.

- That is more than sufficient time for most startups to give their investors an exit.

- CCPS also helps founders keep control of a company even if their stake is lower than that of investors.