Today Current Affairs: 1st November 2021 for UPSC IAS exams, State PSC exams, SSC CGL, State SSC, RRB, Railways, Banking Exam & IBPS, etc

Table of Contents

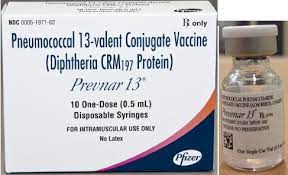

Pneumococcal 13-Valent Conjugate Vaccine (PCV):

The government has launched a nationwide expansion of Pneumococcal 13-valent Conjugate Vaccine (PCV) under the Universal Immunisation Programme (UIP) as a part of ‘Azadi ka Amrit Mahotsav’.

- It was for the first time in the country that PCV would be available for universal use.

- PCV13 protects against 13 types of bacteria that cause pneumococcal disease.

- Pneumonia caused by pneumococcus is the most common cause of severe pneumonia in children.

- Pneumonia was a leading cause of death among children under five, globally and in India. Around 16% of deaths in children occur due to pneumonia in India.

- Pneumococcal disease refers to any illness caused by pneumococcal bacteria. These bacteria can cause many types of illnesses, including pneumonia, which is an infection of the lungs. Pneumococcal bacteria are one of the most common causes of pneumonia.

Universal Immunization Programme:

- It was launched in 1985 to prevent mortality and morbidity in children and pregnant women against 12 vaccine-preventable diseases.

- Under UIP, free of cost vaccination is provided against twelve vaccine-preventable diseases i.e. Tuberculosis, Diphtheria, Pertussis, Tetanus, Polio, Hepatitis B, Pneumonia and Meningitis due to Haemophilus Influenzae type b (Hib), Measles, Rubella, Japanese Encephalitis (JE) and Rotavirus diarrhoea.

- The programme is one of the largest health programmes in the world. Despite being operational for many years, UIP has been able to fully immunize only 65% of children under 1 year of age.

Report On Suicides Among Farm Workers: NCRB

National Crime Records Bureau (NCRB) has released a report on Suicides among farm workers.

- The number of agricultural labourers who died by suicide in 2020 was 18% higher than the previous year.

- Overall, 10,677 people engaged in the farm sector died by suicide in 2020.

- However, suicides among landowning farmers dropped slightly during the pandemic year.

- Landless agricultural labourers, who did not benefit from income support schemes such as PM Kisan, may have faced higher levels of distress during the pandemic.

- The worst among the States continues to be Maharashtra, with 4,006 suicides in the farm sector, including a 15% increase in farm worker suicides.

- Other States with a poor record include Karnataka (2016), Andhra Pradesh (889) and Madhya Pradesh (735). Karnataka saw a dismal 43% increase in the number of farm worker suicides in 2020.

Data Protection Bill 2019:

The Unique Identification Authority of India (UIDAI) has asked for exemption from the Personal Data Protection (PDP) Law.

- UIDAI functionaries said the authority is already being governed by the Aadhaar Act and there cannot be duplicity of laws.

The Personal Data Protection (PDP) Bill 2019:

- The genesis of this Bill lies in the report prepared by a Committee of Experts headed by Justice B.N. Srikrishna.

- The committee was constituted by the government in the course of hearings before the Supreme Court in the right to privacy case (Justice K.S. Puttaswamy v. Union of India).

- As per the bill, it is the individual whose data is being stored and processed.

- Social media companies, which are deemed significant data fiduciaries based on factors such as volume and sensitivity of data as well as their turnover, should develop their own user verification mechanism.

- An independent regulator Data Protection Agency (DPA) will oversee assessments and audits and definition making.

- Each company will have a Data Protection Officer (DPO) who will liaison with the DPA for auditing, grievance redressal, recording maintenance and more.

- The bill also grants individuals the right to data portability, and the ability to access and transfer one’s own data.

- The right to be forgotten: This right allows an individual to remove consent for data collection and disclosure.

- The Personal Data Protection (PDP) Bill 2019 has a contentious section 35, which invokes “sovereignty and integrity of India,” “public order”, “friendly relations with foreign states” and “security of the state” to give powers to the Central government to suspend all or any of the provisions of this Act for government agencies.

MGNREGA:

The Centre’s flagship rural employment scheme (MGNREGA) has run out of funds halfway through the financial year. This means that payments for MGNREGA workers as well as material costs will be delayed, unless the States dip into their own funds.

- Earlier, the government introduced the category-wise wage payment system for SC, ST and others, as made applicable from this current financial year (2021-22), to accurately reflect on the ground flow of funds to various population groups.

MGNREGA Scheme:

- The Mahatma Gandhi National Rural Employment Guarantee Act, earlier known as the National Rural Employment Guarantee Act was passed in 2005 to augment employment generation and social security in India.

- The scheme is a demand-driven wage employment scheme, which functions under the Ministry of Rural Development.

- Every adult member of a household in a rural area with a job card is eligible for a job under the scheme.

- The scheme envisages providing 100 days of guaranteed wage employment in a financial year to adult member volunteers for unskilled manual work.

- It covers all districts of India except the ones with 100% urban population.

- There is also a provision for additional 50 days of unskilled wage employment in drought/natural calamity notified rural areas.

- As per Section 3(4) of the MGNREGA, the States may make provisions for providing additional days beyond the period guaranteed under the Act from their own funds.

SWAMIH Fund:

The SWAMIH (Special Window for Affordable & Mid-Income Housing) fund has made its first complete exit from an investment made for completion of a residential project in Mumbai.

- It has already completed over 1,500 homes in seven projects and is on track to complete at least 10,000 homes every year.

- This is a government backed fund that was set up as a Category-II AIF (Alternate Investment Fund) debt fund registered with SEBI (Securities and Exchange Board of India), launched in 2019.

- Liquidity squeeze and the cash trap situation that the real estate sector faced in 2019 made things difficult, prompting the government to launch this scheme.

- Liquidity squeeze or cash trap is a situation where interest rates are as low so that investors prefer to save rather than invest.

- The Investment Manager of the Fund is SBI(State Bank of India)CAP Ventures, a wholly-owned subsidiary of SBI Capital Markets, which in turn is a wholly-owned subsidiary of the SBI.

- The Sponsor of the Fund is the Secretary, Department of Economic Affairs, Ministry of Finance, on behalf of the Government of India.

- Eligibility Criteria: The real estate projects seeking last-mile funding from SWAMIH must be Real Estate (Regulation and Development) Act (RERA)-registered which have been stalled due to a lack of adequate funds.

- Each of these projects must be very close to completion.

- They must also fall under the ‘Affordable and Middle Income Project’ category (any housing projects wherein housing units do not exceed 200 sq.m.).

- Net-worth positive projects are also eligible for SWAMIH funding. Net-worth positive projects are those projects for which the value of their receivables (debts owed to them by buyers), plus the value of their unsold inventories is greater than their completion costs and outstanding liabilities

- Aim:To provide financing to enable completion of stalled housing projects and ensure delivery of apartments to homebuyers.

- Significance of Fund: It helps unlock liquidity in the real estate sector and provide a boost to core industries such as cement and steel.

Samudrayaan Mission:

The Ministry of Earth Sciences (MoES) has launched India’s first manned ocean mission “Samudrayaan” in Chennai.

- With this Unique Ocean Mission, India joined the elite club of nations such as the US, Russia, France, Japan, and China to have niche technology and vehicles to carry out subsea activities.

- It is India’s first unique manned ocean mission that aims to send men into the deep sea in a submersible vehicle for deep-ocean exploration and mining of rare minerals.

- It will send three persons in a manned submersible vehicle MATSYA 6000 to a depth of 6000 metres into the sea for deep underwater studies. Submarines go only about 200 metres.

- It is a part of the Rs 6000-crores Deep Ocean Mission.

Deep Ocean Mission:

- It was approved in June 2021 by the (MoES). It aims to explore the deep ocean for resources, develop deep-sea technologies for sustainable use of ocean resources, and support the Blue Economy Initiatives of the Indian Government.

- The cost of the Mission has been estimated at Rs. 4,077 crore over a five-year period and will be implemented in phases.

MATSYA 6000:

- It is an indigenously developed manned submersible vehicle.

- It will facilitate the MoES in conducting deep ocean exploration of resources such as gas hydrates, polymetallic manganese nodules, hydro-thermal sulfides, and cobalt crusts which are located at an approximate depth between 1000 and 5500 metres.

- Polymetallic nodules, also called manganese nodules, are mineral concretions on the sea bottom formed of concentric layers of iron and manganese hydroxides around a core.

Current Account Rules:

The Reserve Bank of India eased Current Account Rules for bank exposures less than five crore rupees allowing lenders to open current accounts, cash credit and overdraft facilities without any restriction.

- The Apex Bank asked banks to implement the changes within one month.

- For borrowers, where the exposure of the banking system is less than five crore rupees, there is no restriction on the opening of current accounts or on the provision of CC/OD facility by banks, subject to obtaining an undertaking from such borrowers that they will inform the banks when the credit facilities availed by them from the banking system reaches five crore rupees or more.

- It added that borrowers where the exposure is more than five crore rupees, will continue to maintain current accounts with any one of the banks with which they have cash credit or overdraft facility, provided that the bank has at least 10 per cent of the exposure of the banking system to that borrower.

- The banking regulator also permitted banks to open and maintain inter-bank accounts, all accounts with institutions like EXIM Bank, NABARD, NHB and SIDBI account attached by orders of Central or State Government and investigative agencies without any restrictions.

- RBI’s new rules aim to discipline current account usage to monitor cash flows efficiently and control siphoning of funds by regulating an already over-regulated sector.

Amendments To Energy Conservation Act, 2001:

Amidst the growing energy needs and changing global climate landscape, the Government of India has identified new areas to achieve higher levels of penetration of Renewable energy by proposing certain Amendments to Energy Conservation Act, 2001.

- The objective will be to enhance demand for renewable energy at the end- use sectors such as Industry, buildings, transport etc.

- The proposal includes defining minimum share of renewable energy in the overall consumption by the industrial units or any establishment. There will be provision to incentivise efforts on using clean energy sources by means of carbon saving certificate.

- The proposed amendments would facilitate development of Carbon market in India and prescribe minimum consumption of renewable energy either as direct consumption or indirect use through grid. This will help in reduction of fossil fuel based energy consumption and carbon emission to the atmosphere.

- The proposed changes to the EC Act will boost the adoption of clean technologies in various sectors of economy. The provisions would facilitate promotion of green Hydrogen as an alternate to the existing fossil fuels used by the Industries.

- The additional incentives in the form of Carbon credits against deployment of clean technologies will result in private sector involvement in climate actions.

- The proposal also includes expanding the scope of Act to include larger Residential buildings, with an aim to promote Sustainable Habitat.

Pan-India Legal Awareness Program For Women:

The National Commission for Women (NCW), along with National Legal Services Authority (NALSA) has launched a pan-India Legal Awareness Program for Women, “Empowerment of Women through Legal Awareness” to impart practical knowledge about legal rights.

- The programme was launched in Varanasi, Uttar Pradesh by Justice UU Lalit, Judge Supreme Court of India and Executive Chairman, NALSA, Chairperson, National Commission for Women.

- The programme aims to cover all the States and Union Territories across the country through regular sessions to make women aware of the various machineries of the justice delivery system available for redressal of their grievances.

- The project will sensitize women and girls about their rights as provided under the various laws including the Indian Penal Code.

- The project will also make them aware of the procedure of approaching and utilizing various channels available for the redressal of grievances, i.e., the Police, the Executive and the Judiciary.

- Earlier, the Commission had launched a pilot project ‘Legal Awareness Programme’ in collaboration with NALSA for women at the grass-root levelon August 15, 2020.

- The Pilot project had covered all the districts of 8 States, Uttar Pradesh, Maharashtra, West Bengal, Madhya Pradesh, Rajasthan, Andhra Pradesh, Telangana and Assam.