Today Current Affairs: 1st February 2021 for UPSC IAS exams, State PSC exams, SSC CGL, State SSC, RRB, Railways, Banking Exam & IBPS, etc

Table of Contents

Budget 2021:

Finance Minister Nirmala Sitharaman said that the Budget proposals for this financial year rest on six pillars — health and well-being, physical and financial capital and infrastructure, inclusive development for aspirational India, reinvigorating human capital, innovation, and R&D, and ‘Minimum Government, Maximum Governance’.

Significant announcements included a slew of hikes in customs duty to benefit Make in India, a proposal to disinvest two more PSBs and a general insurance company, and numerous infrastructure pledges to poll-bound States.

- The fiscal deficit stands at 9.5% of the GDP and is estimated to be 6.8% in 2021-22. Personal income tax slabs remain as is.

Union Budget 2021 Highlights:

Health and Sanitation:

- A new scheme, titled PM Atma Nirbhar Swasthya Bharat Yojana, to be launched to develop primary, secondary and tertiary healthcare

- Mission POSHAN 2.0 to improve nutritional outcomes across 112 aspirational districts

- Operationalization of 17 new public health units at points of entry

- Modernising of existing health units at 32 airports, 15 seaports and land ports

- Jal Jeevan Mission Urban aimed at better water supply nationwide

- Strengthening of Urban Swachh Bharat Mission

Education:

- 100 new Sainik Schools to be set up

- 750 Eklavya schools to be set up in tribal areas

- A Central University to come up in Ladakh

Infrastructure:

- Vehicle scrapping policy to phase out old and unfit vehicles – all vehicles to undergo fitness test in automated fitness centres every 20 years (personal vehicles), every 15 years (commercial vehicles)

- Highway and road works announced in Kerala, Tamil Nadu, West Bengal and Assam

- National Asset Monetising Pipeline launched to monitor asset monetisation process

- National Rail Plan created to bring a future ready Railway system by 2030

- 100% electrification of Railways to be completed by 2023

- Metro services announced in 27 cities, plus additional allocations for Kochi Metro, Chennai Metro Phase 2, Bengaluru Metro Phase 2A and B, Nashik and Nagpur Metros

- National Hydrogen Mission to be launched to generate hydrogen from green power sources

- Recycling capacity of ports to be doubled by 2024

- Gas pipeline project to be set up in Jammu and Kashmir

- Pradhan Mantri Ujjwala Yojana (LPG scheme) to be extended to cover 1 crore more beneficiaries

Tax:

- No IT filing for people above 75 years who get pension and earn interest from deposits

- The reopening window for IT assessment cases reduced from 6 to 3 years. However, in case of serious tax evasion cases (Rs. 50 lakh or more), it can go up to 10 years

- Affordable housing projects to get a tax holiday for one year

- Compliance burden of small trusts whose annual receipts does not exceed Rs. 5 crore to be eased

- Duty of copper scrap reduced to 2.5%

- Custom duty on gold and silver to be rationalised

- Duty on naphtha reduced to 2.5%.

- Duty on solar inverters raised from 5% to 20%, and on solar lanterns from 5% to 15%

- All nylon products charged with 5% customs duty

- Tunnel boring machines to attract customs duty of 7%

- Customs duty on cotton raised from 0 to 10%

- Agriculture infrastructure and development cess proposed on certain items including urea, apples, crude soyabean and sunflower oil, crude palm oil, kabuli chana and peas

Economy and Finance:

- The fiscal deficit stands at 9.5% of the GDP; estimated to be 6.8% in 2021-22

- Proposal to allow States to raise borrowings up to 4% of GSDP this year

- A Unified Securities Market Code to be created, consolidating provisions of the Sebi Act, Depositories Act, and two other laws

- Proposal to increase FDI limit from 49% to 74%

- An asset reconstruction company will be set up to take over stressed loans

- Deposit insurance increased from Rs 1 lakh to Rs 5 lakh for bank depositors

- Proposal to decriminalise Limited Liability Partnership Act of 2008

- Two PSU bank and one general insurance firm to be disinvested this year

- An IPO of LIC to debut this fiscal

- Strategic sale of BPCL, IDBI Bank, Air India to be completed

Agriculture:

- Agriculture infrastructure fund to be made available for APMCs for augmenting their infrastructure

- 1,000 more Mandis to be integrated into the E-NAM market place

- Five major fishing hubs, including Chennai, Kochi and Paradip, to be developed

- A multipurpose seaweed park to be established in Tamil Nadu

Employment:

- A portal to be launched to maintain information on gig workers and construction workers

- Social security to be extended to gig and platform workers

- Margin capital required for loans via Stand-up India scheme reduced from 25% to 15% for SCs, STs and women

8th India International Silk Fair:

The Textiles Minister of India, Smriti Irani, inaugurated the 8th India International Silk Fair on the Virtual Portal.

Highlights:

- This fair is the biggest silk fair in India.

- The fair is being held under one roof of the virtual platform of Indian Silk Export Promotion Council.

- The fair is a five days long event.

- More than 200 overseas buyers have already registered.

- Further, around 200 overseas representatives in India will interact with more than 100 renowned and big Indian companies who are engaged in manufacturing and trading the silk and silk blended products.

Silk in India:

- Silk is a luxury good in India. Around 97% of the raw mulberry silk is produced in five states namely, Tamil Nadu, Karnataka, Andhra Pradesh, West Bengal, and Gujarat.

- Mysore and North Bangalore will also become the site of a US$20 million Silk City.

- In Tamil Nadu, mulberry silk cultivation is concentrated in Salem, Erode and Dharmapuri districts.

- Hyderabad, Andhra Pradesh and Gobichettipalayam in Tamil Nadu were some of the first locations to establish the automated silk reeling units.

- India is the 2nd largest producer of Silk after China.

- India is also the largest consumer of silk across the world.

- India is also the only country across the world that produces all the four major varieties of silk – Mulberry, Eri, Tassar, and Muga.

Bhashan Char Island:

The Bangladesh Authorities recently moved around 1,750 Rohingya Muslims to a controversial island in the Bay of Bengal called the “Bhashan Char Island”. This move by Bangladesh was opposed by the refugees already living on the island.

About Bhashan Char:

- The island is also known as Char Piya.

- It is in Hatiya Upazila, Bangladesh.

- The island is located in the Bay of Bengal at about 6 kilometres from Sandwip island and 60 kilometres from the mainland. It has an area of 40 square kilometres.

- The island was formed in the year 2006 by Himalayan silt.

- The Government of Bangladesh have planned to construct 1,440 buildings on the island.

- The building will also include 120 cyclone shelters.

- The buildings were constructed with the objective of relocating the 100,000 Rohingya refugees from the mainland camps of Cox’s Bazar.

- Recently, in August 2019, Ashrayan Project (Ashrayan-3) was expended to build 100,000 homes on the island.

Cox’s Bazar

- It is a city, fishing port, tourism centre and district headquarters of the southern Bangladesh.

- This city is famous for long natural sandy beach.

- It is also known as the Panowa.

Sandwip island

- It is an island along the south-eastern coast of Bangladesh in Chittagong District. The island is a part of Sandwip Upazila.

Rohingya people:

- They are a stateless Indo-Aryan ethnic group who follow Islam.

- They reside in the Rakhine State of Myanmar. Around 1.4 million Rohingyas lived in Myanmar until a displacement crisis of 2017 when 740,000 fled to Bangladesh.

- They are called as the most persecuted minorities in the world.

- They are denied citizenship under the 1982 Myanmar nationality law.

- They do not have the freedom of movement, state education and civil service jobs in Myanmar.

14 Minor Forest Produce Items Included Under MSP Scheme:

Highlights:

- This new mechanism will help to provide remunerative and fair prices to tribal gatherers of forest produces.

- The items which have been included in the scheme include- Tasar Cocoon, bamboo shoot, elephant apple dry, wild dry mushroom and malkangani seed.

Minimum Support Price (MSP)

- It is an agricultural product price which is set by the Government of India to purchase directly from the farmer.

- MSP is not enforceable by law.

- This MSP rate is decided to safeguard the farmer to a minimum profit for the harvest in case the open market has lesser price than the cost incurred.

- Price is set for 23 commodities twice a year.

- It is set on the recommendations of the Commission for Agricultural Costs and Prices (CACP) since 2009.

Background

- The Minimum Support Price was announced for the first time in the year 1966-67 for wheat.

- The MSP was decided in the light of Green Revolution and extended harvest in order to save the farmers from depleting profits.

Minor Forest Produce (MFP):

- It includes all non-timber forest produce of plant origin. It also includes bamboo, fodder, leaves, canes, waxes dyes, gums, resins and many forms of food like nuts, honey wild fruits, lac, tusser etc.

- MFP It provides both subsistence and cash income for people living in or near the forests.

MFP through MSP scheme

- It is a centrally sponsored scheme.

- The scheme ensures that the tribal population gets the remunerative price for the MFP and seeks to provide them alternative employment avenues.

- The mechanism for the marketing of minor forest produce through minimum support price and development of value chain for MFP’ scheme is done by the State designated agencies.

- To assure the market price, the services of market correspondents are availed by the designated agencies.

Increased Fiscal Deficit:

The government’s fiscal deficit has increased to Rs. 11.58 lakh crore or 145.5% of the Budget Estimate (BE) at the end of December 2020 (accounting for the first nine months of the year 2020-21) mainly on account of lower revenue realisation.

Key Points:

- Fiscal Deficit Target Fixed for 2020-21: The Centre had pegged the fiscal deficit at Rs. 7.96 lakh crore or 3.5% of the Gross Domestic Product (GDP).

- Fiscal Deficit in 2019-2020: According to the data released by the Controller General of Accounts (CGA), the fiscal deficit at the end of December in the previous fiscal year was 132.4% of the BE of 2019-20.

Reasons for High Fiscal Deficit:

Lower Revenue Realisation:

- Because of disruptions in normal business activity following the coronavirus pandemic and lockdowns.

Higher Expenditure:

- There has been a notable increase in revenue expenditure in food and public distribution and rural development which could be attributed to the government’s pandemic relief programs.

Fiscal Deficit

- The government describes fiscal deficit of India as “the excess of total disbursements from the Consolidated Fund of India, excluding repayment of the debt, over total receipts into the Fund (excluding the debt receipts) during a financial year”.

- In simple words, it is a shortfall in a government’s income compared with its spending.

- The government that has a fiscal deficit is spending beyond its means.

- It is calculated as a percentage of Gross Domestic Product (GDP), or simply as total money spent in excess of income.

- In either case, the income figure includes only taxes and other revenues and excludes money borrowed to make up the shortfall.

Sustainable Development of Little Andaman Island Vision Document by NITI Aayog:

A plan named the Sustainable Development of Little Andaman Island Vision Document by NITI Aayog for the sustainable and holistic development of the 680 sq km, fragile Little Andaman Island in the Andaman and Nicobar island group has raised alarm among conservationists.

Earlier in 2020, the Prime Minister declared that the Andaman and Nicobar islands will be developed as a “maritime and startup hub”.

- Purpose:

- To leverage the strategic location and natural features of the island.

- The islands are critical for India’s security because of their strategic location in the Indian Ocean Region (IOR).

- Better infrastructure and connectivity will help India enhance its military and naval strength in the islands.

- Plan:

- Building a new greenfield coastal city, that will be developed as a free trade zone and will compete with Singapore and Hong Kong.

Three Zones: It has divided the development in three zones:

- Zone 1 :

- Spread over 102 sq km alongside the east coast of Little Andaman.

- It would be the monetary district and medi metropolis and can embody an aerocity, and a tourism and hospital district.

- Zone 2:

- Spread over 85 sq km of pristine forest.

- It is the leisure zone, can have a movie metropolis, a residential district and a tourism Special Economic Zone (SEZ).

- Zone 3 :

- Spread over 52 sq km of pristine forest.

- It shall be a nature zone, additional categorized into three districts: an unique forest resort, a nature therapeutic district and a nature retreat, all on the western coast.

Transport Development:

- A worldwide airport able to deal with all varieties of plane is central to the plan as a global airport is vital for growth.

- The solely jetty on the island might be expanded and a marina might be developed subsequent to the tourist entertainment district.

- A 100 km greenfield ring highway might be constructed parallel to the shoreline from east to west and might be supplemented with a mass fast transit community with stations at common intervals.

Bottlenecks:

- Lack of fine connectivity with Indian mainland and world cities.

- Fragile biodiversity and natural ecosystems and certain Supreme Court notifications that pose an obstacle to development.

- Another key issue is the presence of indigenous tribes and concerns for their welfare.

- 95% of Little Andaman is covered in forest, a big part of it the pristine evergreen sort. Some 640 sq km of the island is Reserve Forest under the Indian Forest Act 1927, and almost 450 sq km is protected because of the Onge Tribal Reserve, creating a singular and uncommon socio-ecological-historical complex of high importance.

National e-Vidhan (NeVA) PROJECT:

Meghalaya State Assembly Speaker visited Arunachal Pradesh Legislative Assembly Secretariat in Itanagar to get first-hand information about the National e-Vidhan project implemented in the Assembly.

- e-Vidhan is a Mission Mode Project (MMP) included in Digital India Programme and Ministry of Parliamentary Affairs (MoPA) is the ‘Nodal Ministry’ for its implementation in all the States/ UTs with Legislatures.

- Funding of NeVA is on the pattern of Central Sponsored Scheme i.e. 60:40; and 90:10 for North East & hilly States and 100% for UTs.

- The funding for e-Vidhan is provided by the MoPA and technical support by Ministry of Electronics and Information Technology (MeitY).

Objectives:

- Paperless Assembly or e-Assembly is a concept involving of electronic means to facilitate the work of Assembly.

- It enables automation of the entire law-making process, tracking of decisions and documents, sharing of information.

- NeVA aims to bring all the legislatures of the country together, in one platform thereby creating a massive data depository without having the complexity of multiple applications.

- Further, live webcasting of Lok Sabha TV and Rajya Sabha TVs is also available on this application.

- Doordarshan has already been enabled with provision to incorporate similar facilities in respect of State Legislatures.

Periyar Tiger Reserve:

For the first time in the country, the Periyar Tiger Reserve (PTR) in Kerala has taken up the training of a tiger cub to equip it to naturally hunt in the forest environment.

- Periyar tiger reserve falls in the districts of Idukki and Pathanamthitta in Kerala (saddled in the southern region of Western Ghats).

- Declared a Sanctuary during 1950 and declared as Tiger Reserve during 1978. It gets its name from the River Periyar which has its origin deep inside the reserve.

- The major rivers through the reserve are Mullayar and Periyar.

- The sanctuary comprises tropical evergreen, semi evergreen, moist deciduous forests and grasslands.

- 516 flowering plants here are endemic to the Western Ghats.

- The sanctuary is a repository of medicinal plants numbering to about 300.

- Some are endemic to the region like Syzygium periyarensis (a tree), Habenaria periyarensis (an orchid) and Mucuna pruriense thekkadiensis (a climber) etc.

- Fauna: Mammals: Tiger, Elephant, Lion-tailed macaque, Nilgiri Tahr etc.

- Birds: Darters, Cormorants, Kingfishers, the great Malabar Hornbill and racket-tailed Drongos.

- Reptiles: Monitor Lizards, Python, King Cobra etc.

- Tribals: There are six tribal communities nestled inside the reserve such as Mannans, Paliyans, Malayarayans, Mala Pandarams, Uralis and Ulladans.

India delivers 2 cranes for Chabahar:

This is part of a bilateral contract between India and Iran signed in May 2016 for $85 million to equip and operationalise the port. Amid talks with Iranian authorities, it signals a push to the port project.India’s plans to invest further in the port project are seen as an indicator that the government expects some easing up in U.S. sanctions in the upcoming months, once the new Biden administration begins to address its policy on re-entering the Iran nuclear deal.

With this, India can bypass Pakistan in transporting goods to Afghanistan. It will also boost India’s access to Iran, the key gateway to the International North-South Transport Corridor that has sea, rail, and road routes between India, Russia, Iran, Europe, and Central Asia. It also helps India counter Chinese presence in the Arabian Sea which China is trying to ensure by helping Pakistan develop the Gwadar port. Gwadar port is less than 400 km from Chabahar by road and 100 km by sea.

- Chabahar Port is Located on the Gulf of Oman and is the only oceanic port in the country.

- With Chabahar port being developed and operated by India, Iran also becomes a military ally to India.

- Chabahar could be used in case China decides to flex its navy muscles by stationing ships in Gwadar port to reckon its upper hand in the Indian Ocean, the Persian Gulf, and the Middle East.

- With Chabahar port becoming functional, there will be a significant boost in the import of iron ore, sugar, and rice to India.

- The import cost of oil to India will also see a considerable decline. India has already increased its crude purchase from Iran since the West imposed a ban on Iran was lifted.

- From a diplomatic perspective, Chabahar port could be used as a point from where humanitarian operations could be coordinated.

Corruption Perception Index 2020:

Corruption Perception Index 2020 has been released.

- It is prepared by Transparency International.

Corruption Perceptions Index (CPI):

- It is a composite index that draws from 12 surveys to rank nations around the globe.

- It has become a benchmark gauge of perceptions of corruption and is used by analysts and investors.

- The index is also based on expert opinions of public sector corruption and takes note of range of factors like whether governmental leaders are held to account or go unpunished for corruption, the perceived prevalence of bribery, and whether public institutions respond to citizens’ needs.

- It ranks 180 countries and territories by their perceived levels of public sector corruption, according to experts and business people.

- It uses a scale of zero to 100, where zero is highly corrupt and 100 is very clean.

India’s performance:

- India slipped six places to 86th position this year.

- India’s score is below the average score of the Asia-Pacific region (31 countries) and global average.

- India’s overall score is also two points less than that of China, which docked at 78th position.

The list was topped by New Zealand and Denmark (88 each).

- South Sudan and Somalia were at the bottom of the global ranking, with scores of 12 each.

ASEAN India Hackathon:

The ASEAN-INDIA Hackathon was inaugurated to further strengthen the India and ASEAN ties.

- The background of the India-ASEAN hackathon lies in Prime Minister Shri Narendra Modi’s call during the India-Singapore hackathon in the year 2019.

- The minister highlighted that the ASEAN-India hackathon will provide a unique opportunity to India and ASEAN countries to solve their common identified challenges.

- The common challenges of the countries are categorized under two themes namely the “Blue Economy” and “Education”.

ASEAN-INDIA Hackathon:

- The ASEAN-INDIA Hackathon initiative is undertaken by the Ministry of Education.

- In the year 2021, the hackathon is being organized online from February 1 to 3, 2021.

- The hackathon will offer new opportunities for all the 10 ASEAN countries and India to strengthen their economic and cultural ties by collaborating into the fields of education, science and technology.

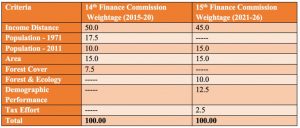

15th Finance Commission’s Final Report:

The Fifteenth Finance Commission of India have submitted its final report for a five-year duration. The report has been submitted with the objective of transforming the financial governance of India’s municipalities.

- The interim report for Financial Year 2020-21 was tabled in Parliament along with Budget 2020-21.

- The final report for Financial Year 2021-22 to Financial Year 2025-26 was tabled along with the Budget 2021-22.

Key Highlights of the report:

- The 15th FC has significantly raised its bar on the financial governance of India’s municipalities in the interim report.

- The final report also maintains these four specific agendas.

The four agendas include:

- The 15th FC has tried to increase the overall outlay for municipalities. It has set 29,000 crores for FY 2020-21.

- It has also indicated the intent to raise the share of municipalities in the total grants of local bodies from 30 percent to 40 percent.

- Two entry conditions have been set for any municipality in India to receive FC grants namely, the publication of audited annual accounts that would help in boosting the financial accountability and notification of floor rates for the property tax that would help in raising the revenue enhancement.

- The 15th finance commission has adopted the approach of distinguishing between million-plus urban agglomerations and other cities.

- It also recommends a common digital platform for municipal accounts, a consolidated view of municipal finances and the sectoral outlays at the state level apart from the digital footprint of individual transactions at the source.

- These four aspects of the interim report highlight that the 15th finance commission aims to bring the logical culmination of municipal finance reforms.

- However, the foundation for bringing about these reforms was also laid by the thirteenth and fourteenth finance commission.

“Voluntary Vehicle Scrappage Policy”:

The Finance minister of India, Nirmala Sitharaman, has proposed for the “Voluntary Vehicle Scrappage Policy”. This proposal was made during the presentation of the Union Budget for Financial Year 2022. The voluntary vehicle scrappage policy will help to scrap out the unfit and pollution-causing vehicles.

The new policy will help in encouraging the fuel-efficient and environment-friendly vehicles. Thus, it will reduce vehicular pollution and cut India’s huge oil import bills. As per the proposed Vehicle Scrappage Policy, if any vehicle fails the fitness test more than thrice, it will be subjected to mandatory scrapping. However, the government is yet to roll out the final scrappage policy.

- The voluntary scrappage policy will be based on fitness tests.

- Life has been set at 20 years in the case of private vehicles while 15 years have been set for commercial vehicles.

- This policy would apply to central and state government-owned vehicles from April 1, 2022.

This announcement by the government has made just after the government’s announcement of a scrappage policy for vehicles that are used by its various departments and public sector undertakings (PSUs). The Ministry of Road Transport and Highways (MoRTH) also approved the vehicle scrappage policy recently for vehicles older than 15 years and that is owned by the government and PSUs.